Bitcoin rates are a hot topic in the world of cryptocurrency, with prices fluctuating rapidly and often unpredictably. To help you navigate this volatile market, we have compiled a list of 4 articles that will provide you with valuable insights and strategies for understanding and predicting Bitcoin rates. From expert analysis to practical tips, these articles will equip you with the knowledge you need to make informed decisions and maximize your investment potential.

Understanding the Factors Influencing Bitcoin Price Fluctuations

Bitcoin, the world's most popular cryptocurrency, has seen significant price fluctuations over the years. Understanding the factors that influence these price movements is crucial for investors and traders looking to make informed decisions in the volatile market.

-

Market Demand and Supply: Like any other asset, the price of Bitcoin is primarily driven by the forces of supply and demand. When demand exceeds supply, prices tend to rise, and vice versa.

-

Regulatory Environment: Government regulations can have a significant impact on the price of Bitcoin. News of regulatory crackdowns or endorsements can cause prices to fluctuate rapidly.

-

Investor Sentiment: The sentiment of investors and traders in the market can also influence Bitcoin prices. Positive news or market sentiment can drive prices up, while negative sentiment can lead to a sell-off.

-

Technological Developments: Technological advancements in the blockchain and cryptocurrency space can impact the price of Bitcoin. Improvements in security, scalability, and usability can drive prices higher.

-

Market Speculation: Speculation plays a significant role in the price fluctuations of Bitcoin. Traders looking to profit from short-term price movements can cause prices to swing wildly.

5 Tips for Predicting Bitcoin Rates

Bitcoin, the world's most popular cryptocurrency, has been a hot topic in the financial world for quite some time now. Investors are always looking for ways to predict Bitcoin rates in order to make informed decisions about their investments. In this article, we will discuss five tips that can help you forecast Bitcoin rates with more accuracy.

Firstly, it is essential to stay updated with the latest news and trends in the cryptocurrency market. Any significant events or announcements can have a direct impact on Bitcoin rates. Secondly, technical analysis can be a useful tool in predicting price movements. By analyzing historical price data and identifying patterns, you can make more informed predictions about future price movements.

Thirdly, keeping an eye on market sentiment is crucial. Social media platforms and online forums can provide valuable insights into the mood of investors, which can influence Bitcoin rates. Additionally, understanding the fundamentals of Bitcoin, such as its scarcity and utility, can help you predict its long-term value.

In conclusion, predicting Bitcoin rates can be a challenging task, but by following these tips, you can increase your chances of making accurate forecasts. By staying informed, utilizing technical analysis, monitoring market sentiment, and understanding the fundamentals of Bitcoin, you can make more informed investment decisions in the cryptocurrency market.

Recommendations:

- Consider exploring

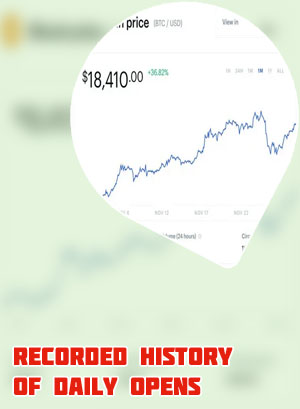

Analyzing Historical Data to Forecast Bitcoin Price Trends

In the ever-evolving world of cryptocurrency, staying ahead of market trends is crucial for investors looking to make informed decisions. One method that has gained popularity in recent years is analyzing historical data to forecast price trends. By examining past patterns and behaviors of the market, analysts can gain valuable insights into potential future movements of Bitcoin prices.

One key aspect of analyzing historical data is identifying recurring patterns or trends that have influenced past price movements. By understanding these patterns, investors can better predict potential future price fluctuations and make more informed decisions regarding when to buy or sell Bitcoin.

Another important factor to consider when analyzing historical data is the impact of external events on Bitcoin prices. Factors such as regulatory changes, macroeconomic trends, and market sentiment can all influence the price of Bitcoin. By taking these external factors into account, analysts can gain a more comprehensive understanding of the market and make more accurate forecasts.

Furthermore, analyzing historical data can help investors identify potential support and resistance levels for Bitcoin prices. These levels can serve as important indicators of potential price movements, helping investors set appropriate entry and exit points for their trades.

In conclusion, analyzing historical data is a valuable tool for forecasting Bitcoin price trends. By identifying patterns, considering external factors, and pinpointing support and resistance levels, investors can make more informed decisions and

Strategies for Managing Risk in a Volatile Bitcoin Market

In the fast-paced and unpredictable world of cryptocurrency trading, managing risk is paramount for investors looking to navigate the volatile Bitcoin market successfully. With prices fluctuating wildly and market sentiment often swinging dramatically, having a solid risk management strategy in place can make all the difference between success and failure.

One key strategy for managing risk in a volatile Bitcoin market is diversification. By spreading investments across different assets, investors can mitigate the impact of a sudden price drop in one particular cryptocurrency. This approach helps to reduce overall portfolio risk and provides a buffer against market turbulence.

Another important risk management technique is setting stop-loss orders. Stop-loss orders automatically trigger a sale when a cryptocurrency reaches a certain price, helping investors limit potential losses and protect their capital. By using stop-loss orders strategically, investors can minimize downside risk while still allowing for potential upside gains.

Additionally, staying informed about market trends and developments is crucial for managing risk in the Bitcoin market. By keeping up to date with news and analysis, investors can make more informed decisions and adapt their strategies in response to changing market conditions.

In conclusion, managing risk in a volatile Bitcoin market requires a combination of diversification, stop-loss orders, and staying informed about market trends. By implementing these strategies effectively, investors can navigate the ups and downs of the cryptocurrency market